The aerospace and defence industry continues to be a hotbed of innovation, with activity driven by the need to lower operational costs, larger consumer trends, and electrification, and growing importance of technologies such as hydrogen and electric aircraft and advanced materials. In the last three years alone, there have been over 174,000 patents filed and granted in the aerospace and defence industry, according to GlobalData’s report on Environment Sustainability in Aerospace, Defence & Security: Contrarotating propeller spinners. Buy the report here.

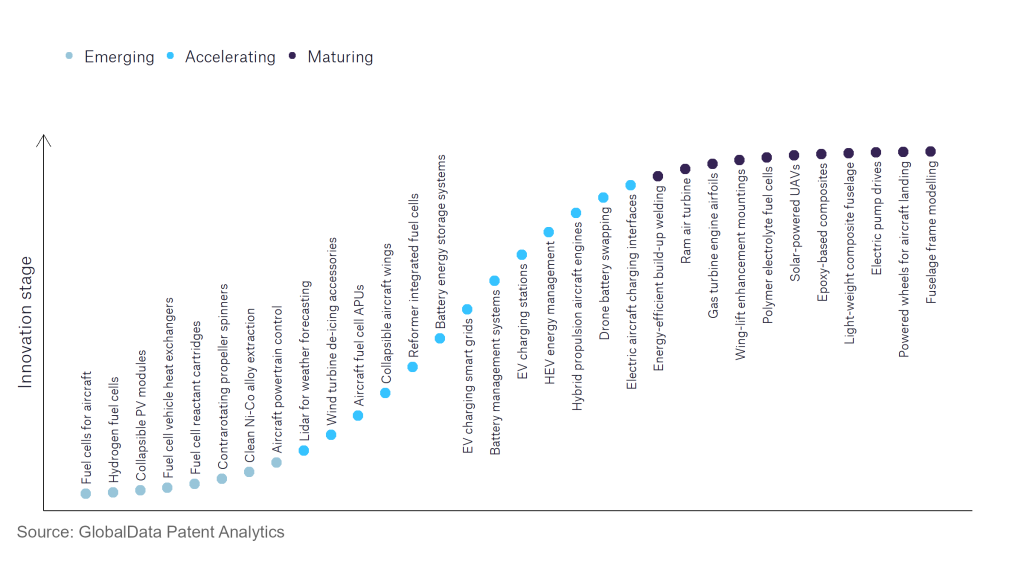

However, not all innovations are equal and nor do they follow a constant upward trend. Instead, their evolution takes the form of an S-shaped curve that reflects their typical lifecycle from early emergence to accelerating adoption, before finally stabilising and reaching maturity.

Identifying where a particular innovation is on this journey, especially those that are in the emerging and accelerating stages, is essential for understanding their current level of adoption and the likely future trajectory and impact they will have.

180+ innovations will shape the aerospace and defence industry

According to GlobalData’s Technology Foresights, which plots the S-curve for the aerospace and defence industry using innovation intensity models built on over 262,000 patents, there are 180+ innovation areas that will shape the future of the industry.

Within the emerging innovation stage, hydrogen fuel cells, aircraft powertrain control, and fuel cells for aircrafts are disruptive technologies that are in the early stages of application and should be tracked closely. EV charging stations, hybrid propulsion aircraft engines and electric aircraft charging interfaces are some of the accelerating innovation areas, where adoption has been steadily increasing. Among maturing innovation areas are fuselage frame modelling and powered wheels for aircraft landing, which are now well established in the industry.

Innovation S-curve for environmental sustainability in the aerospace and defence industry

Contrarotating propellers is a key innovation area in environmental sustainability

Contrarotating propellers are a pair of propellers that rotate in opposite direction to one another, cancelling out each other’s torque and bringing efficiency benefits.

GlobalData’s analysis also uncovers the companies at the forefront of each innovation area and assesses the potential reach and impact of their patenting activity across different applications and geographies. According to GlobalData, there are 10+ companies, spanning technology vendors, established aerospace and defence companies, and up-and-coming start-ups engaged in the development and application of contrarotating propellers.

Key players in contrarotating propeller spinners – a disruptive innovation in the aerospace and defence industry

‘Application diversity’ measures the number of different applications identified for each relevant patent and broadly splits companies into either ‘niche’ or ‘diversified’ innovators.

‘Geographic reach’ refers to the number of different countries each relevant patent is registered in and reflects the breadth of geographic application intended, ranging from ‘global’ to ‘local’.

Patent volumes related to contrarotating propeller spinners

| Company | Total patents (2021 - 2023) | Premium intelligence on the world's largest companies |

| Safran | 778 | Unlock Company Profile |

| Rolls-Royce Holdings | 213 | Unlock Company Profile |

| General Electric | 127 | Unlock Company Profile |

| Raytheon Technologies | 100 | Unlock Company Profile |

| Airbus | 93 | Unlock Company Profile |

| Boeing | 28 | Unlock Company Profile |

| Textron | 23 | Unlock Company Profile |

| Office National d'Etudes et Aerospace Research | 8 | Unlock Company Profile |

| Uber Technologies | 8 | Unlock Company Profile |

| Amazon.com | 8 | Unlock Company Profile |

| Honda Motor | 7 | Unlock Company Profile |

| Kawasaki Heavy Industries | 7 | Unlock Company Profile |

| Deutsches Zentrum fur Luft- und Raumfahrt | 6 | Unlock Company Profile |

Source: GlobalData Patent Analytics

Amongst aerospace and defence companies, Safran is the leading patent holder in contrarotating propellers. The firm is heavily invested in the production of aircraft engines for both civil and defence customers. These include the TP400 engine, a turboprop engine installed on the A400M. Other key patent filers include other leading aerospace primes and aircraft engine providers such as Rolls-Royce, General Electric, Raytheon Technologies, Airbus, and Boeing.

In terms of application diversity, Raytheon Technologies holds the most widely applicable patents in contrarotating propellers amongst aerospace and defence companies. General Electric and Rolls-Royce come in at second and third place, respectively. Regarding geographic reach, Deutsches Zentrum fur Luft holds the top spot, followed by Boeing and Safran.

In a future aerospace market, shaped by consumer expectations and government regulation, aerospace firms will be driven to produce products that deliver a reduced climate impact. Whilst novel technologies such as sustainable aviation fuels, all-electric aircraft, and hydrogen production will deliver substantial reduction in emissions from the industry, other technologies that can bring incremental improvements to efficiency, such as contrarotating propellers will also play a role.

To further understand the key themes and technologies disrupting the aerospace and defence industry, access GlobalData’s latest thematic research report on Defence.

Data Insights

From

The gold standard of business intelligence.

Blending expert knowledge with cutting-edge technology, GlobalData’s unrivalled proprietary data will enable you to decode what’s happening in your market. You can make better informed decisions and gain a future-proof advantage over your competitors.