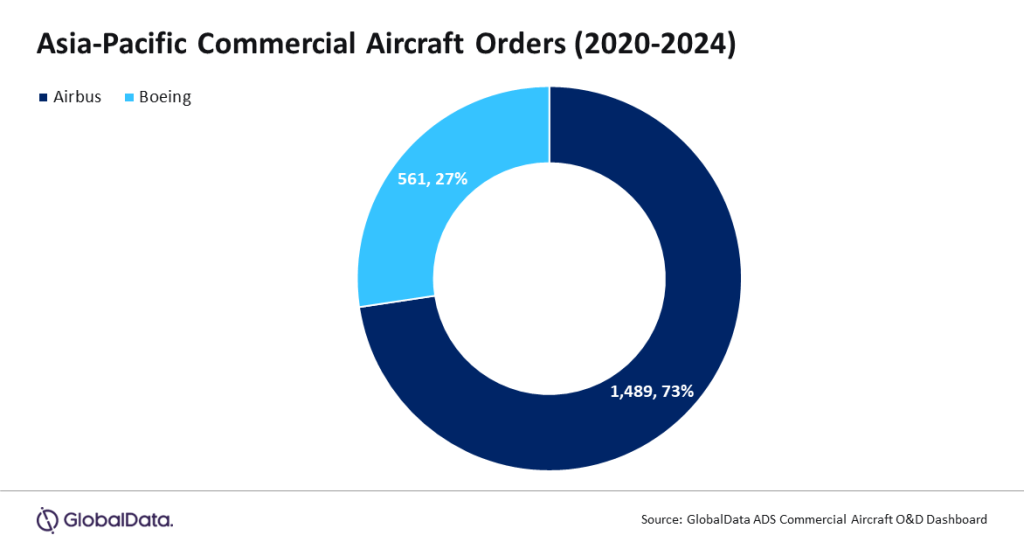

With a strong order book from airline operators and leasing companies based in India, China, and Singapore during 2020–2024, Airbus has fortified its position in the Asia-Pacific (APAC) commercial aircraft market amid continued Boeing‘s woes.

As it is being scrutinized for multiple mishaps involving its 737 Max aircraft line, Boeing continues to lose ground in the APAC region to its biggest competitor, said GlobalData analysts.

GlobalData’s dashboard Commercial Aircraft Orders and Deliveries revealed that in the APAC region, Airbus received a total of 1,489 aircraft orders between 2020 and 2024 (until March 2024), compared to only 561 aircraft orders for Boeing.

Gone Sai Kiran, aerospace and defense analyst at GlobalData said: “Notable Airbus customers in the region, including Indigo Airlines, Air India, China Eastern Airlines, China Southern Airlines, and BOC Aviation, have either chosen not to order from Boeing or have ordered fewer units from Boeing as compared to Airbus.

“Indigo Airlines has the highest number of Airbus orders of 510 aircraft, compared to none from Boeing. On the other hand, Air India has ordered 250 aircraft from Airbus, complemented by 220 aircraft from Boeing.

“BOC Aviation and China Eastern Airlines have ordered 107 and 100 aircraft from Airbus, respectively, omitting Boeing from their procurement portfolio. A major reason for Chinese airline operators to avoid ordering from Boeing could be the US-China trade war that was witnessed in recent years.”

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataGlobalData’s dashboard also showed Airbus has outpaced Boeing in terms of deliveries. Between 2020 and 2024, Airbus delivered 2,717 aircraft, while Boeing managed to deliver only 1,594 aircraft. Boeing, which had plans to increase the production capacity of its top-selling aircraft model, the 737 Max, is currently facing severe challenges on multiple fronts as the US Federal Aviation Administration (FAA) froze its expansion plans in January 2024 due to an ongoing audit of its existing production lines.

This is further expected to affect Boeing’s aircraft delivery rate in the coming years.

“Ongoing allegations on Boeing’s production quality standards and the FAA’s decree to airlines to halt operations of some Boeing aircraft models have led to multiple cancellations of Boeing orders recently. These events have been favorable for Airbus in a gaining competitive edge in this mainly duopoly market,” Kiran concluded.